your Strategic Partners

Accounting and planning for profitable business growth

Employee Ownership Trusts

An EOT is where employees own a significant portion or all of a company’s shares, it is gaining popularity for its advantages in succession planning. It helps maintain independence, rewards hard work, and offers fair compensation to outgoing shareholders. It attracts talent, fosters a positive culture, and is not a new concept, exemplified by the John Lewis Partnership established in 1929. We strongly believe that employee ownership is a practical and effective option for many businesses.

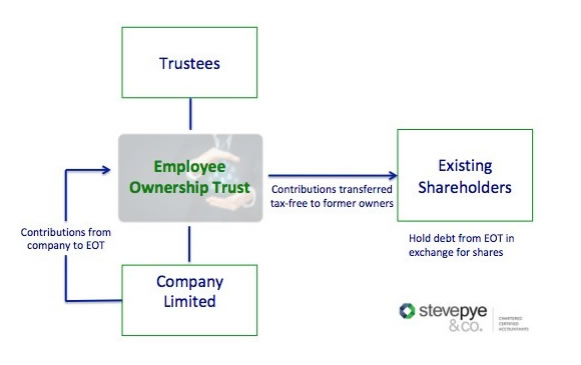

How does an Employee Ownership Trust work?

- Employee Ownership Trust (EOT): An EOT is a trust created specifically to hold shares on behalf of employees in a company.

- Tax Benefits: EOTs offer significant tax advantages for sellers. To qualify for these benefits, the EOT must meet certain criteria: Controlling Interest: The EOT must hold more than 50% of the company’s shares, giving it a controlling interest. Benefit for All Employees: The EOT should be established for the benefit of all employees (with a few exceptions for individuals who hold or have held 5% of the shares). Equitable Treatment: The EOT must treat all employees fairly and equally.

- Capital Gains Tax Relief: By transferring a controlling stake to an EOT, sellers can obtain relief from Capital Gains Tax (CGT) that would otherwise be payable. This enhances the value of the sale for the outgoing shareholders.

How do I set up an Employee Ownership Trust?

- Current shareholders (vendors) sell 51-100% of business shares to the EOT.

- Vendors usually pay no capital gains tax on shares sold when EOT acquires over 50% of shares.

- EOT pays for shares using third-party financing and a loan from the vendors. Vendors receive payments in installments, and third-party financing is repaid through company contributions.

- To align interests, the company may issue shares or warrants/options to key managers and employees.

- Eligible employees can receive income tax-free bonus payments of up to £3,600 per employee per annum.

Funding an Employee Ownership Trust

Funding employee ownership can be achieved through various options, with the following approach being commonly used:

- The Employee Ownership Trust (EOT) borrows money from lenders, which can include third-party senior, subordinated, and/or vendor financing.

- The lenders take charge of the company’s assets as collateral. The company provides contributions to the EOT to cover interest, fees, and loan repayment as per the contractual obligation.

- Over time, the loan to the EOT is repaid through contributions made to the trust by the company.

Employee-owned businesses are taxed similarly to other types of businesses, although there are two notable differences:

- When a controlling stake is transferred to an Employee Ownership Trust, the sale becomes exempt from Capital Gains Tax (CGT) that would otherwise be required.

- Additionally, each employee has the opportunity to receive an annual bonus payment of up to £3,600, which is not subject to income tax.

I have been a client of Steve Pye & Co for many years and Steve has always been proactive and efficient. As I looked ahead at the succession options for my company, Steve advised that it would be a good fit for an Employee Ownership Trust (EOT) and spent time explaining the process, which seemed an attractive solution. The decision to proceed has changed our lives (as my wife would say) and has enabled us to secure the future of our company, its employees, ethos, and core values. The decision to become an EOT has also enabled us to benefit from substantial tax savings. The advice and experience that Steve and his team have offered during the EOT process have been invaluable to us.

Phil Congreve, Gedney Bulb Company Ltd, March 2023

For SME Owners

Our accounting services for Small and Medium-sized Enterprises (SMEs) offer tailored financial solutions to support your business’s growth, streamline operations, and ensure compliance.

For Individuals

As someone at the helm of a business, we understand that the journey can sometimes feel overwhelming and isolating. That’s why we’re here to help.

For Corporations

We know that navigating the landscape of corporate business operations requires more than just numbers – it demands a strategic approach and attention to detail.